Who has to pay company car tax?

As a general rule: owner registered in the vehicle register Exceptions:

- In the case of a finance lease of a car with a registration number (Hungarian number plate), the lessee must

- In the case of a passenger car not registered (foreign registration number), the person/organisation who invoices the cost.

When does the tax liability arise and cease?

In which cases is company car tax not incurred?

- Reimbursement of expenses incurred by a company for the official use of a car owned by an individual does not give rise to a liability for company car tax, provided that the individual does not declare the costs of using the car as an itemized expense (for example, a fuel or service invoice submitted by an employee is considered an itemized expense).

- For private cars owned by private individuals, reimbursement of the cost of official or business travel on the basis of a travel order (mileage and mileage), if the amount paid for travel does not exceed the amount that can be deducted without a certificate, as defined by law.

- Reimbursement of the cost of travelling to work by private car for days spent at work or for the return journey by public transport between the place of work and the place of residence, provided that the distance does not exceed the rate laid down by law.

- Environmentally friendly vehicles: vehicles registered in the following categories

- SE - purely electric car

- SP - Plug-in hybrid car

- 5N - Hybrid electric car with increased range

- 5Z - zero emission (hydrogen cell) car

- Vehicles with the following number plates:

- CD - diplomats

- OT - oldtimer

- Z - with temporary registration plate

What is the company car tax rate and how can it be reduced? As of 01.07.2022, the company car tax rate has changed as follows:

|

POWER (kW) |

For environmental categories "0" to "4" |

For environmental categories „6" to „10" |

For environmental categories „5", „14” and „15” |

|

0-50 |

30 500 forint |

16 000 forint |

14 000 forint |

|

51-90 |

41 000 forint |

20 000 forint |

16 000 forint |

|

91-120 |

61 000 forint |

41 000 forint |

20 000 forint |

|

120 felett |

81 000 forint |

61 000 forint |

41 000 forint |

Reducing company car tax - excluding double taxation

If the company car tax and the motor vehicle tax are paid by the same person, the monthly company car tax rate per quarter may be reduced by the monthly amount of the motor vehicle tax paid on time (03.15, 09.15).

The tax return must be submitted and paid to the National Tax and Customs Administration quarterly, by the 20th day of the month following the quarter.

Car tax

From 2021, the National Tax and Customs Administration has taken over the task of administering and collecting the tax.

The tax is payable on the first day of the year (1 January) by the keeper of the vehicle entered in the vehicle register or, failing this, by the owner.

Car tax rates:

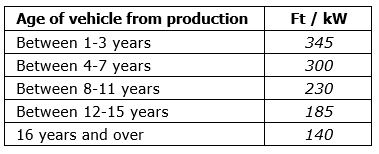

- The tax rate for passenger cars depends on the year of manufacture and the power (kW) of the car.

- in the case of a bus, its unladen weight,

- in the case of a lorry, its unladen weight and its tare weight.

For passenger cars, the tax rate is as follows:

Tax return and tax payment deadlines:

At the beginning of each tax year, the National Tax and Customs Board sends taxpayers a motor vehicle tax decision setting out the annual tax liability.

The annual motor vehicle tax is payable in two equal instalments per year, the first instalment by 15 March of the year in question and the second instalment by 15 September of the year in question.