Who can opt for flat-rate taxation?

The right to opt for flat-rate taxation is available to both self-employed persons who start their activity during the year and those who are already operating. The start-up of a sole proprietorship must be initiated through the Web Agency.

Flat tax on annual income:

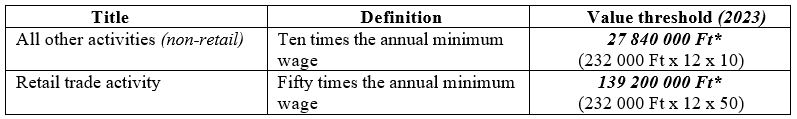

The income of a self-employed person opting for the flat-rate taxation rules may not exceed the following amounts.

*If the activity starts during the year, the income threshold must be determined pro rata temporis according to calendar days!

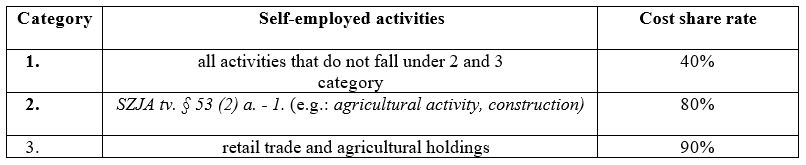

Cost ratios for each activity:

Income assessment:

The realised income received should be reduced by the % of costs corresponding to the activity. The difference thus obtained determines the income.

Realized income – Cost Ratio = Income

Tax-free income - Personal Income Tax:

Flat-rate income is tax-free if it does not exceed half of the annual minimum wage.

*The tax-free income does not need to be prorated for a business that starts during the year!

Taxes and contributions payable:

The tax liabilities on taxable income are as follows:

- 15% personal income tax (PIT)

- 18.5% social security contribution (SSC)

- 13% social contribution tax (SZOCHO)

Income tax and dividend tax are not assessed when applying flat-rate taxation!

Social security contributions and social contribution tax - determination of the tax base:

The following method is used to determine the monthly tax base for social security contributions and social contribution tax for a self-employed person using the flat-rate method:

(Aktualis es megelozo negyedevekben megszerzett SZJA koteles jovedelem - megelozo negyedevek tenylegesjarulekalapja)

Targynegyedevben biztositott honapok szama

The social security contribution (TBJ) for full-time employees must be paid at least on the current minimum wage / guaranteed minimum wage!

The social contribution tax (SZOCHO) must be paid on at least 112.5% of the current minimum wage / guaranteed minimum wage for full-time employees!

Paying tax advances, paying tax and filing personal income tax returns:

During the year, the self-employed person has an obligation to pay tax advances and to declare contributions by the 12th day of the month following the quarter.

In a side job, the sole proprietor is only liable for tax on income exceeding the tax-free income!

In the case of a pensioner, you only have to pay 15% personal income tax on the amount of tax-free income you receive